Business Insurance in and around Aurora

One of the top small business insurance companies in Aurora, and beyond.

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, errors and omissions liability and business continuity plans, you can feel confident that your small business is properly protected.

One of the top small business insurance companies in Aurora, and beyond.

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

When you've put so much personal interest in a small business like yours, whether it's an arts and crafts store, a floor covering installer, or a tailoring service, having the right protection for you is important. As a business owner, as well, State Farm agent Mike Lucas understands and is happy to offer customizable insurance options to fit your needs.

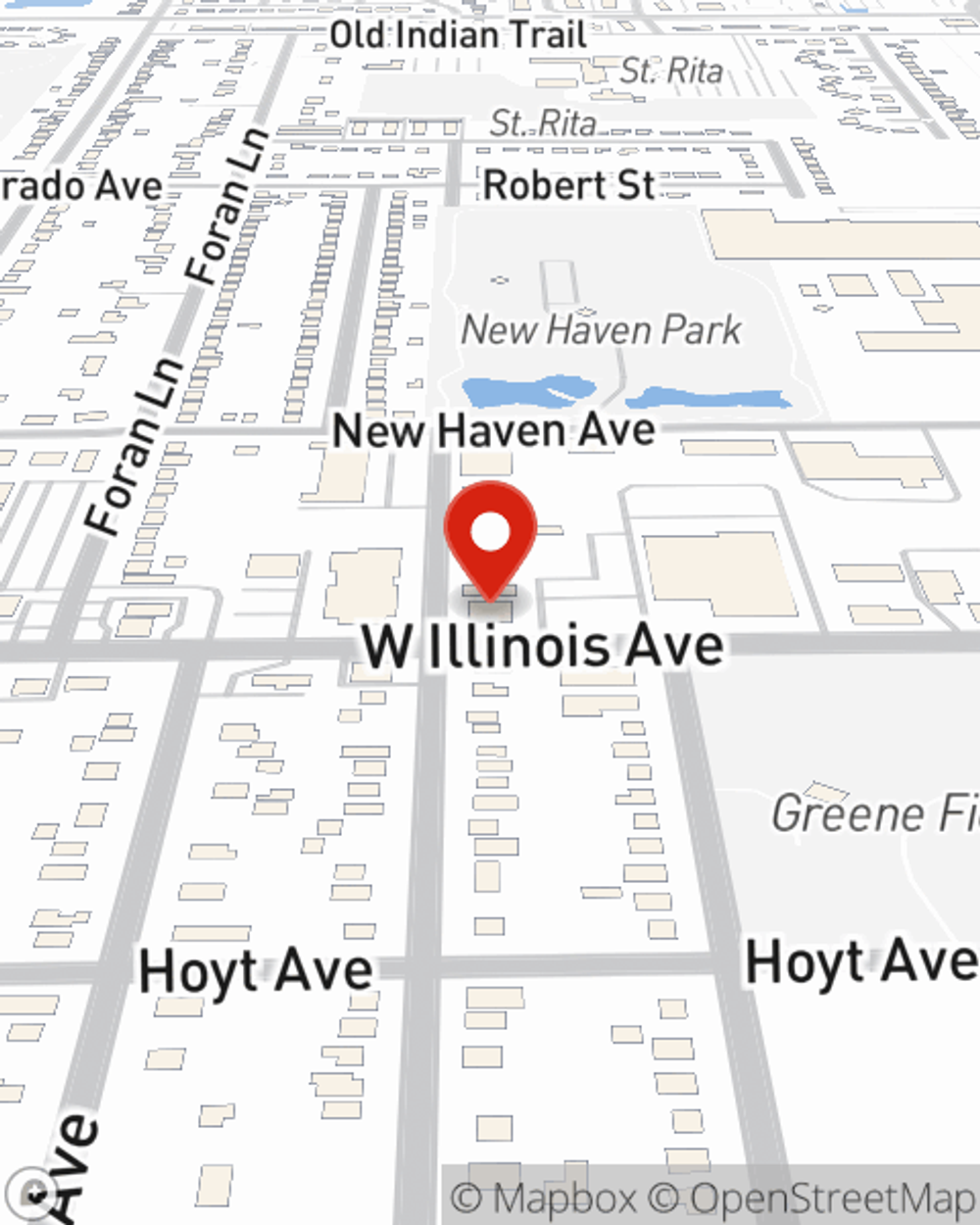

Get right down to business by visiting agent Mike Lucas's team to learn more about your options.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Mike Lucas

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".